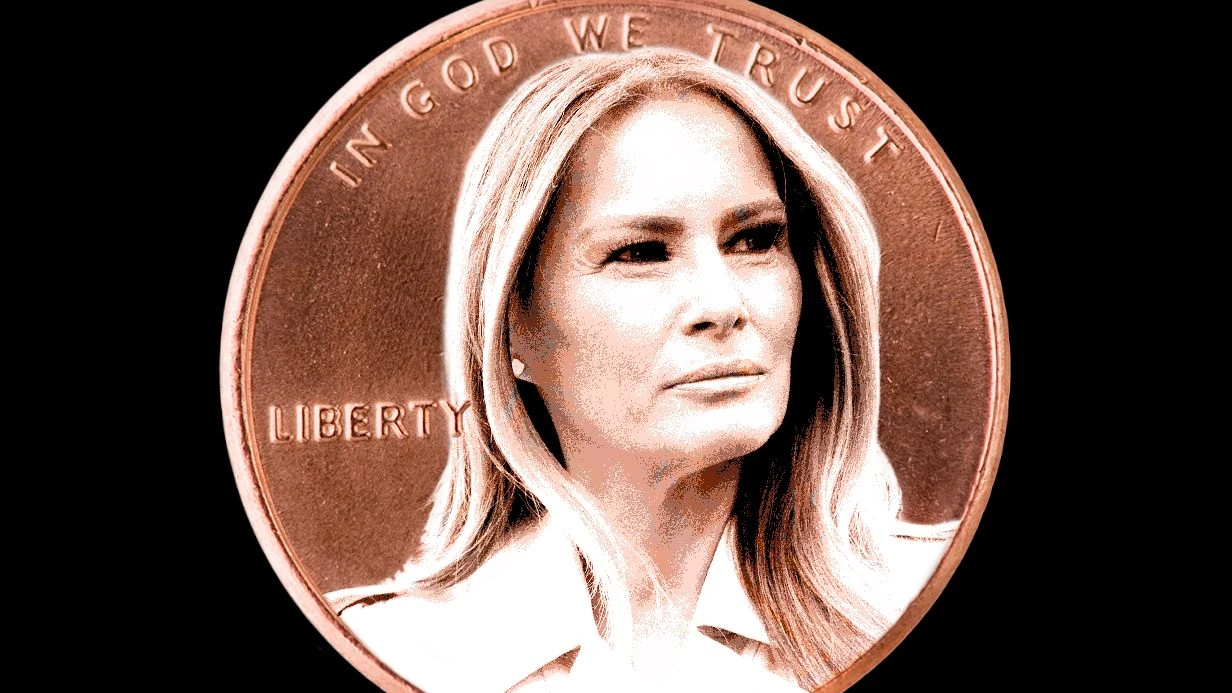

A recent legal filing has alleged that a cryptocurrency promoted by US First Lady Melania Trump in January was part of an elaborate fraud scheme. This scheme, it is claimed, “leveraged celebrity association and ‘borrowed fame’ to confer legitimacy upon unsuspecting investors.”

In April, cryptocurrency investors initiated a federal class – action lawsuit against Benjamin Chow, the co – founder of the crypto exchange Meteora, and Hayden Davis, the co – founder of the crypto venture – capital firm Kelsier Labs, along with other defendants. The plaintiffs accused them of a multimillion – dollar fraud involving a single memecoin, $M3M3.

Subsequently, the plaintiffs filed an amended complaint, broadening the allegations to encompass racketeering activities. They asserted that the pair had colluded to manipulate the market for $LIBRA, a coin promoted by Javier Milei, the President of Argentina. This coin witnessed a significant decline in value shortly after its launch.

On Tuesday, the plaintiffs sought the court’s authorization to file yet another amended complaint, this time based on purported information from an anonymous whistleblower. The proposed second – amended complaint alleges that, with Chow acting as the “commander,” the duo launched, pumped, and dumped at least 15 cryptocurrency coins, including $MELANIA. The scheme is alleged to have caused millions of dollars in losses to unwitting investors.

The proposed second – amended complaint contends that Trump, who is not named as a defendant in the lawsuit, was utilized as “window dressing for a crime engineered by Meteora and Kelsier.” The filing further clarifies that the plaintiffs do not allege that Trump or Milei “operated the scheme.”

Max Burwick, the senior managing partner at Burwick Law, the law firm representing the plaintiffs, stated, “This case has the potential to clarify the fundamental expectations regarding token launches and disclosures in the US. We are aware that numerous individuals across the crypto industry and the regulatory community are closely monitoring this matter.”

The White House, Chow, and Davis did not immediately respond to requests for comment.

The investors assert that by the time Chow and Davis launched $MELANIA in January, they had refined a “repeatable six – step ‘playbook’ for pump – and – dump fraud.”

According to the proposed second – amended complaint, Meteora controls the technical infrastructure, while Kelsier supplies the requisite capital and orchestrates the promotional campaign, relying heavily on the credibility borrowed from public figures or brands. The filing alleges that together, they effectively manage a network of “sniper” crypto wallets. These wallets acquire large quantities of the coins at artificially discounted prices and then unload them onto the market as regular investors begin to invest.

In a private exchange, which is presented in redacted form as an exhibit in the lawsuit, Davis informed an acquaintance prior to the $MELANIA launch, “Going to try to tell all my buddies early. I’m about to launch the biggest token ever lol.” (It remains unclear whether Davis was allegedly referring to $MELANIA or $LIBRA.)

The proposed second – amended complaint alleges that before the launch, Davis prepared a meticulously coordinated marketing campaign for $MELANIA. He recruited a network of paid crypto influencers to simultaneously inundate social – media platforms with promotional messaging. The filing claims that the influencers pitched the coin as “fair launch” and “community – led.”

In the hours following the commencement of public trading, as the hype built and investors rushed to purchase $MELANIA, the coin’s price increased twelve – fold. At its peak, the coin had a paper value of $1.6 billion. Since then, it has lost 95 percent of its peak value.

The proposed second – amended complaint claims, “Investors reasonably construed the use of Melania Trump’s name and likeness as evidence of legitimacy and due diligence, trusting that an individual of her stature would not knowingly associate with a fraudulent venture.”

However, prior to the launch, wallets controlled by Meteora and Kelsier had allegedly amassed nearly a third of the entire $MELANIA supply. The proposed filing alleges, “Insiders had already cornered the market before a single public buyer could act.”

As the $MELANIA price rose, the insider wallets began to sell, earning millions of dollars within hours of the launch, as per the proposed second – amended complaint. These large – scale sales led to a price collapse, causing substantial losses to the regular investors who had bought in.

Although the complaint does not allege any wrongdoing on Trump’s part, her family has faced significant criticism for its numerous forays into the crypto industry. Critics have characterized these activities as a blatant conflict of interest. The Financial Times recently estimated that the Trump family had earned over $1 billion from its crypto – related pursuits since Donald Trump was re – elected as US President.

The proposed second – amended complaint alleges, “The misuse of Melania Trump’s name exacerbated the harm. It eroded public trust and introduced an element of political and cultural credibility into what was, in essence, a typical pump – and – dump scheme.”